Why Using Your EPF for Home Construction is a Smart Move 💡 | RumahHQ

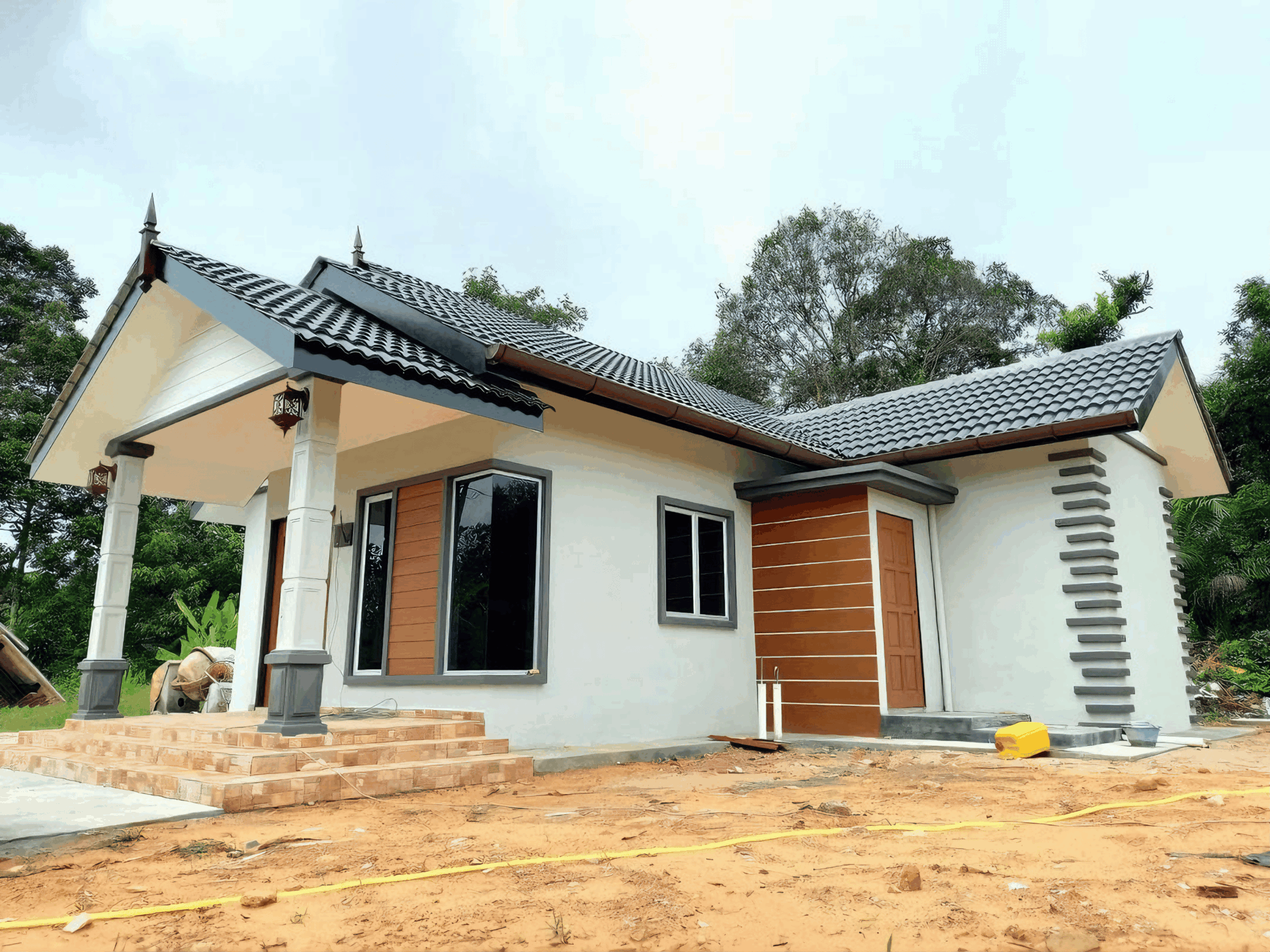

Hey there! If you’re juggling the idea of building your dream home but feeling a little overwhelmed about the costs, you’re not alone. Let’s face it—constructing a home in Malaysia can be a hefty investment, and the financial planning can sometimes feel like a maze. But what if I told you that your Employee Provident Fund (EPF) could be the key to unlocking that new door? Yep, you heard that right! Using your EPF for home construction can be a smart move that not only eases your financial burden but also brings you closer to your home sweet home. So, let’s dive into why tapping into your EPF might just be the game-changer you didn’t know you needed! 🏡💰

Unleashing the Potential of Your EPF for Home Construction

Using your EPF (Employees Provident Fund) for home construction is more than just a financial maneuver; it’s an investment in your future. With the rising costs of real estate, many Malaysians are looking for innovative ways to secure their own piece of the Malaysian dream. Tapping into your EPF balance allows you to leverage your hard-earned savings to build a home that not only meets your needs but also enhances your financial portfolio. It’s like turning what you’ve saved into a tangible asset!

When you decide to use your EPF for construction, you unlock a range of benefits:

- Attractive Financing: By utilizing your EPF, you reduce the need for additional loans, which can save on interest payments in the long run.

- Tax Benefits: Contributions and withdrawals for housing can provide potential tax advantages that help you save even more money.

- Flexibility: You have control over how your house is built, from the design to the materials, which lets you create a space that truly reflects your lifestyle.

To put things into perspective, let’s take a look at the potential savings and returns when choosing to build your home using your EPF:

| Aspect | Savings |

|---|---|

| Interest on Housing Loan | Up to 5% per annum |

| Potential Tax Deductions | Up to RM 10,000 |

| Value Appreciation of Property | 8% - 12% annually |

With this strategic use of your EPF, you can effectively channel your savings into building a lasting legacy. Not only will you have a place to call your own, but you will also cultivate an investment that can appreciate over time, providing financial security for you and your family. In the long run, this approach aligns your immediate needs with long-term financial goals.

Understanding the Benefits of Using EPF Contributions Wisely

Opting to utilize your EPF contributions wisely for home construction can bring multiple benefits that you might not have thought about. First off, it can ease the financial burden. Instead of taking a hefty loan with high interest rates, using your EPF balance allows you to rely on your savings, meaning you can build your home without the worry of escalating debts. You’re essentially investing in your future while achieving your dream of home ownership.

Another remarkable benefit is the flexibility of repayment. When you use your EPF savings, you’re not tied into stringent repayment plans that can strain your finances. Instead, you can pay it forward at your own pace, using your earnings or savings after your home is completed. This flexible structure helps you manage your finances better, allowing you to divert funds into other essential areas like education or retirement planning.

Let’s not forget the potential appreciation in property value. Investing in home construction with your EPF contributes not just to a structure but to an asset that appreciates over time. Here’s a simple table showcasing the potential benefits of this strategic move:

| Aspect | Benefit |

|---|---|

| Financial Freedom | No high-interest loans |

| Flexibility | Custom repayment schedule |

| Asset Growth | Potential appreciation in value |

Incorporating these advantages in your planning can not only enhance your living situation but also set you up for financial success in the long run! Embrace the opportunity your EPF contributions provide and pave the way for financial independence through home ownership.

Mapping Your Financial Strategy: EPF vs. Traditional Loans

When it comes to building your dream home, the financial options can be overwhelming. Using your Employees Provident Fund (EPF) savings is not just a loan; it’s an investment in your future. Unlike traditional loans that come with hefty interest rates and lengthy repayment terms, tapping into your EPF allows you to access funds at minimal to no interest. Think about it: your savings working for you without the burden of monthly loan installments!

Let’s break down the benefits:

- Flexible Usage: You can use EPF funds for construction, renovations, or even paying off existing loans.

- Lower Financial Strain: With no monthly repayments to worry about, you can allocate your income towards other life expenses.

- Ownership Boost: Investing your own money means sooner ownership; you aren’t a slave to bank schedules.

While traditional loans may seem appealing for quick access to larger sums of money, the long-term consequences often outweigh the short-term benefits. Take a look at the comparison:

| Factor | EPF Withdrawal | Traditional Loan |

|---|---|---|

| Interest Rate | Minimal/None | Higher |

| Repayment Terms | No Monthly Repayment | Fixed Monthly Payments |

| Funding Time | Lengthy Approval Process |

Navigating the EPF Withdrawal Process for Home Building

When it comes to building your dream home, knowing how to navigate the EPF withdrawal process can make all the difference. First off, you should gather all necessary documents for a smooth application. Keep in mind the following essentials:

- EPF membership details

- Property ownership documents

- Construction agreement or contract

Once you have all your documents ready, it’s time to dive into the actual process. You can either visit your local EPF office or make use of the online facility for a more convenient approach. Following these steps can save you both time and hassle:

| Step | Action |

|---|---|

| 1 | Fill out the EPF withdrawal form |

| 2 | Submit required documents |

| 3 | Wait for approval notification |

| 4 | Receive funds directly to your bank |

Don’t forget to keep track of your application status through the EPF portal. It’s crucial to stay informed during this phase. If your application gets rejected, there’s always a chance to appeal or make adjustments to your submission. Just remember, using your EPF wisely for home construction not only eases your financial burden but also sets the foundation for a future that’s built on your terms.

Enhancing Your Property Value Through Smart Construction Choices

Making smart construction choices can significantly boost the value of your property, especially when leveraging your EPF (Employee Provident Fund). By utilizing your savings, you can opt for high-quality materials and professional services that ensure durability and appeal. Focusing on long-term investments, such as energy-efficient systems or sustainable building practices, can set your home apart in a competitive real estate market.

Consider the following benefits when planning your construction project:

- Improved Aesthetics: A well-designed layout and contemporary finishes can instantly elevate the look of your home.

- Increased Functionality: Smart space planning can enhance your home’s usability, making it more attractive to potential buyers.

- Long-term Savings: Investing in energy-efficient appliances or smart home technology might take upfront capital but can save you money in the long run.

To illustrate this impact on property value, take a look at the table below that outlines potential return on investment (ROI) for various construction choices:

| Construction Choice | Average ROI (%) |

|---|---|

| Kitchen Renovation | 75% |

| Bathroom Upgrade | 60% |

| Energy-Efficient Windows | 85% |

| New Roof | 70% |

By making informed decisions and adopting a forward-thinking approach, you can transform your property into a valuable asset that aligns with modern living standards, ultimately benefiting you and future residents alike.

Tax Implications and Financial Planning for EPF Utilization

Utilizing your EPF (Employee Provident Fund) for home construction may seem like a straightforward choice, but it’s essential to understand the tax implications that come with it. Withdrawals from your EPF account for housing purposes are generally exempt from income tax, and this can be a significant advantage for home builders. By not paying taxes on this sum, you can allocate more resources towards your construction project. It’s also advisable to keep track of all your transactions and withdrawal records, as these can come in handy when filing your personal tax returns.

When planning financially, consider creating a clear budget for your home construction. Make use of your EPF funds wisely, aligning your spending with your construction timeline. Here’s a quick checklist to help you manage your finances more effectively:

- Define your overall budget – Know your total EPF withdrawal limits and additional funding sources.

- Track your expenses - Keep receipts and maintain a log of your spending to stay within limits.

- Set aside emergency funds – Home construction often comes with unexpected expenses; having a reserve can prevent financial strain.

Moreover, it’s wise to explore the potential returns on investment your new home could bring. In Malaysia, property values generally appreciate over time, meaning your EPF withdrawal is not just an expense but also a potential asset that could grow in value. A simple comparison of projected expenses vs. property appreciation can solidify your decision. Here’s a table that illustrates a basic perspective on this:

| Investment Area | Estimated Cost | Projected Value Increase (5 years) |

|---|---|---|

| New Construction | RM 300,000 | RM 360,000 |

| Land | RM 150,000 | RM 180,000 |

| Home Improvements | RM 50,000 | RM 60,000 |

Incorporating Sustainable Practices in Your Home Construction

When you’re diving into home construction, think of it as an opportunity to not just build a house but create a sustainable living space. Incorporating eco-friendly materials and design principles can significantly reduce your carbon footprint. Here are a few simple and effective ways to elevate your project:

- Use Recycled and Local Materials: Instead of depending on materials that must be shipped from afar, look around you. Utilize local suppliers for construction materials, which can cut down on transportation emissions. Reclaimed wood and recycled metal can add a unique flair to your home while promoting sustainability.

- Invest in Energy Efficiency: Opt for energy-efficient appliances and lighting solutions. Think about installing solar panels or opting for systems that maximize natural light, reducing your dependency on artificial sources. Efficient insulation is also key to maintaining a comfortable temperature year-round.

- Water Conservation Techniques: Implementing techniques like rainwater harvesting or greywater recycling can minimize water wastage. Low-flow fixtures and drought-resistant landscaping can significantly reduce water consumption, making your home a model for sustainability.

Another fun idea is incorporating smart technology systems into your home. These systems can monitor energy usage and even help automate functions to achieve maximum efficiency. By utilizing sensors and programmable devices, you can manage heating, cooling, and lighting much better, thereby saving on both energy and costs.

| Feature | Benefit |

|---|---|

| Solar Panels | Reduces electricity bills and carbon footprint |

| Rainwater Harvesting | Minimizes water usage and relies on a natural resource |

| Energy-Efficient Windows | Improves insulation and reduces heating/cooling costs |

By embracing these sustainable practices in your home construction, you’ll not only foster a better environment but also create a space that’s mindful of resource management. As you watch your eco-friendly home come together, you’ll realize that being sustainable is not just a trend—it’s a lifestyle choice that pays off in the long run!

Securing Your Future: Long-Term Gains of Using EPF for Housing

Using your EPF (Employees Provident Fund) for home construction isn’t just a smart choice for present comfort; it sets a solid foundation for your future. By investing in real estate, you’re not only securing a roof over your head but also building equity that can appreciate over time. This appreciation can translate into significant wealth accumulation, providing you with a financial cushion for unexpected expenses, retirement, or even funding your children’s education.

When you utilize your EPF funds wisely, you can enjoy various long-term advantages. Consider these key points:

- Financial Independence: Owning a home reduces your dependency on rental markets.

- Asset Appreciation: Real estate typically appreciates over time, which adds to your net worth.

- Tax Benefits: Certain home loan interests may be tax-deductible, providing financial relief.

Moreover, financing your home with EPF can lead to a stress-free living situation. Instead of worrying about fluctuating rental prices or the constraints of tenancy agreements, you gain the freedom that comes with homeownership. Here’s a simple table showcasing the potential financial highlights when you invest in housing using EPF:

| Aspect | Benefits |

|---|---|

| Equity Growth | Home value increases over time |

| Stable Payments | Fixed mortgage rates provide predictable expenses |

| Community Investment | Build ties in your neighborhood |

By tapping into your EPF for housing, you’re not just planning for today; you’re crafting a brighter, more secure tomorrow. With the right home, you can foster stability, growth, and a sense of belonging that aligns perfectly with your long-term aspirations.

Concluding Remarks

So there you have it! Using your EPF for home construction isn’t just a smart financial move, it’s also a step towards crafting the home of your dreams. Whether you’re looking to build your first cozy nest or expand your living space, tapping into your EPF can make a significant difference. Just remember to consider all your options and plan wisely, so you can enjoy those sweet rewards down the line.

So, if you’re at that crossroad, think about the way your EPF funds can work for you—not just as a safety net, but as a launching pad into a home that fits your lifestyle. Go on, take that leap, and let your EPF pave the way to your perfect abode. Happy building, everyone! 🏡✨