How RumahHQ’s Financing Flexibility is Helping Malaysians Own Homes Faster | RumahHQ

In a country where owning a home is often seen as a distant dream, RumahHQ is stepping up to shake things up. With a fresh take on financing, they’re making homeownership feel not just possible but also faster than ever for many Malaysians. Imagine a world where the burden of hefty deposits and complicated paperwork is eased, paving the way for more folks to turn the key to their very own front door. Sounds too good to be true? Let’s dive into how RumahHQ’s innovative approach is rolling out a welcome mat to homebuyers across Malaysia, helping them navigate the tricky path to homeownership with a bit more ease and a lot more flexibility.

Understanding RumahHQs Unique Financing Model

In today’s landscape of homeownership, RumahHQ stands out with its innovative financing approach, tailored to meet the unique needs of Malaysians. By breaking away from traditional banking norms, RumahHQ offers a blend of flexibility and accessibility that can markedly shorten the journey to homeownership. Their financing model incorporates aspects such as customizable repayment plans, low entry barriers, and transparent fees, which together create a more manageable path for prospective homeowners.

One of the key features that sets RumahHQ apart is their emphasis on personalized financing solutions. Buyers can engage in discussions with financial advisors to determine what suits their financial situation best. This includes options like:

- Flexible payment terms: Choose terms that align with personal cash flows.

- Low down payment requirements: Making it easier for first-time buyers.

- No hidden charges: Clear communication about fees and costs.

Understanding the importance of easing the financial load, RumahHQ also employs a model that integrates community support. They encourage collective purchasing, where groups of buyers can band together to leverage better financing terms. The following table summarizes the advantages of this collaborative approach:

| Benefit | Description |

|---|---|

| Better Negotiation Power | Groups can secure lower interest rates and favorable terms. |

| Shared Resources | Pooling finances reduces individual burden. |

| Community Support | Shared experiences and tips create a more informed buyer community. |

Empowering First-Time Homebuyers with Adaptable Plans

First-time homebuyers often face a multitude of challenges, from understanding the financing options available to navigating the complex property market. Yet, with RumahHQ’s innovative financing solutions, this daunting journey is made significantly easier. The organization’s approach centers around flexibility and personalization, allowing buyers to tailor their financing plans to fit their individual needs and circumstances. This method not only alleviates financial strain but also empowers buyers to make informed decisions regarding their future.

One of the standout features of RumahHQ’s offerings is the option to choose between various financing terms. Buyers can opt for extended repayment periods, allowing for lower monthly payments, or they can select shorter terms to pay off their mortgage quicker. Additionally, RumahHQ provides various options for an initial down payment, ensuring that customers can enter the housing market without overwhelming financial pressure. Some of the popular choices include:

- Minimal down payment options for those with limited savings.

- Flexibility in loan amounts based on the buyer’s financial standing.

- Customized repayment plans that accommodate seasonal income fluctuations.

The commitment to creating a supportive environment doesn’t stop there. RumahHQ also offers a dedicated team of advisors who work closely with homebuyers, guiding them through every step of the process. This includes invaluable assistance in understanding market trends, effective budgeting strategies, and navigating legal requirements. With an accessible online platform, potential homeowners can easily calculate their financing options and projections, making homeownership a more tangible reality. Here’s a simple overview of how RumahHQ facilitates access to homeownership:

| Feature | Description |

|---|---|

| Personalized Financing Plans | Tailored to suit individual income and lifestyle. |

| Expert Advisory Services | Professional guidance throughout your homebuying journey. |

| Accessible Online Tools | Easy-to-use calculators and resources for informed decisions. |

Streamlined Approval Processes for Quick Decisions

House-hunting can be a marathon, but with RumahHQ, the journey just got a lot smoother. Homebuyers can now experience a swift approval process that cuts through the red tape traditionally associated with securing financing. By leveraging advanced technology and streamlined workflows, RumahHQ ensures that decisions are made quickly, allowing you to focus on what really matters—finding your dream home.

One of the standout features of RumahHQ’s approach is the integration of digital tools that allow for real-time updates and transparency throughout the approval process. Instead of waiting anxiously for weeks, you can enjoy quick turnarounds that help you stay ahead in the competitive property market. Some benefits of this modernized approach include:

- Instant Notifications: Get updates as soon as your application is reviewed.

- Online Trackers: Monitor progress from your device 24/7.

- Less Paperwork: Simplified forms that reduce hassle and save time.

To illustrate just how efficient RumahHQ’s financing process can be, here’s a quick comparison of traditional vs. RumahHQ’s approach:

| Aspect | Traditional Financing | RumahHQ Financing |

|---|---|---|

| Approval Time | Up to 4 weeks | Just 3-5 days |

| Paperwork | Extensive documentation | Minimal documentation |

| Communication | Infrequent updates | Real-time notifications |

This approach not only accelerates your journey to homeownership but also instills confidence and peace of mind as you navigate the process. With RumahHQ, homeownership is no longer just a dream deferred; it’s a reality that can happen faster than you ever imagined.

The Role of Technology in Simplifying Home Financing

In today’s fast-paced world, technology has become a game-changer in how we approach home financing. With the rise of digital platforms, homeowners are no longer confined to traditional banking limitations. Instead, they can access a range of financing options from the comfort of their own homes. This shift not only enhances communication between borrowers and lenders but also expedites the entire process, allowing Malaysians to make informed decisions quicker than ever. As we delve deeper, it’s clear that tech is playing a pivotal role in streamlining loan applications and approvals.

One of the standout features of RumahHQ is its intuitive online platform that simplifies the financing journey. Within minutes, users can:

- Compare financing options from various providers to find the best fit for their needs.

- Submit applications digitally, eliminating the need for tedious paperwork.

- Track the status of their applications in real-time, providing peace of mind and transparency.

This kind of accessibility ensures that potential homeowners have all the information at their fingertips, which is crucial in making sound financial decisions.

Moreover, RumahHQ embraces data analytics and machine learning to refine lending criteria, allowing for more personalized financing solutions. By analyzing user behavior and preferences, lenders can offer tailored advice and unique packages that resonate with individual circumstances. This proactive approach not only minimizes rejection rates but also facilitates a smoother approval process. As a consequence, more Malaysians are stepping closer to owning their dream homes — and that’s a powerful transformation for the housing market.

Personalized Financial Solutions Tailored to Individual Needs

At RumahHQ, we understand that no two journeys to homeownership are the same. That’s why our approach to financing is all about customizing solutions that fit the unique circumstances of each individual. By leveraging advanced technology and data analytics, we can assess your financial profile and offer you options that align not only with your income but also with your lifestyle aspirations. This means you can explore financing choices that truly cater to your needs, ensuring that every Malaysian has a genuine shot at owning their dream home.

Our financing flexibility extends to a variety of tailored programs that assess factors like your employment stability, credit history, and future earning potential. The process is simple yet effective; once you share your basic financial details, our team can craft a plan that includes:

- Flexible repayment terms: Choose a schedule that works for you.

- Low initial deposit options: Get into your home sooner without breaking the bank.

- Interest rate options: Lock in a rate that suits your budget and financial goals.

Here’s a quick comparison of how RumahHQ stands out in the financing landscape:

| Feature | Traditional Financing | RumahHQ Financing |

|---|---|---|

| Initial Deposit | At least 10% of property value | As low as 3% |

| Repayment Flexibility | Fixed payment schedules | Customizable to your needs |

| Approval Speed | Days to weeks | Minutes to hours |

Choosing RumahHQ means embracing a path where your individual financial needs are our priority. We combine state-of-the-art technology with deep local insights to help you navigate the complex world of home financing. From first-time buyers to seasoned investors, our personalized approach brings you closer to homeownership in a way that fits seamlessly into your life. Together, we can revolutionize the way Malaysians own homes!

Building Financial Literacy Among Malaysian Homebuyers

Buying a home is one of the biggest financial commitments many Malaysians will ever make. It’s crucial for homebuyers to understand not only their financing options but also how to navigate the entire mortgage process. With RumahHQ’s unique approach, aspiring homeowners are gaining access to educational resources tailored for their needs. These resources often include workshops and online materials that explain the ins and outs of mortgages, costs involved, and the importance of budgeting for future expenses.

One of the standout features of RumahHQ is their financing flexibility. This means that homebuyers can choose from various loan structures that best fit their financial situation. These options help reduce the burden on first-time buyers who may not have substantial savings upfront. Here are some key benefits:

- Lower Down Payments: Options are available that require less money down, making homeownership more accessible.

- Flexible Repayment Plans: Homebuyers can select a repayment schedule that aligns with their income.

- Integrated Budgeting Tools: Helps potential homeowners to plan their finances effectively.

As the market evolves, so does the need for better financial literacy among homebuyers. RumahHQ underscores this through easy-to-use online calculators, comprehensive guides, and personalized consultations. To give you a clearer overview of how financing flexibility can work in your favor, consider the following table that compares traditional versus RumahHQ’s financing options:

| Aspect | Traditional Financing | RumahHQ Financing |

|---|---|---|

| Down Payment | 20% of the property price | As low as 5% |

| Loan Tenure | 15-30 years | 10-35 years flexible options |

| Prepayment Penalties | Often apply | No penalties |

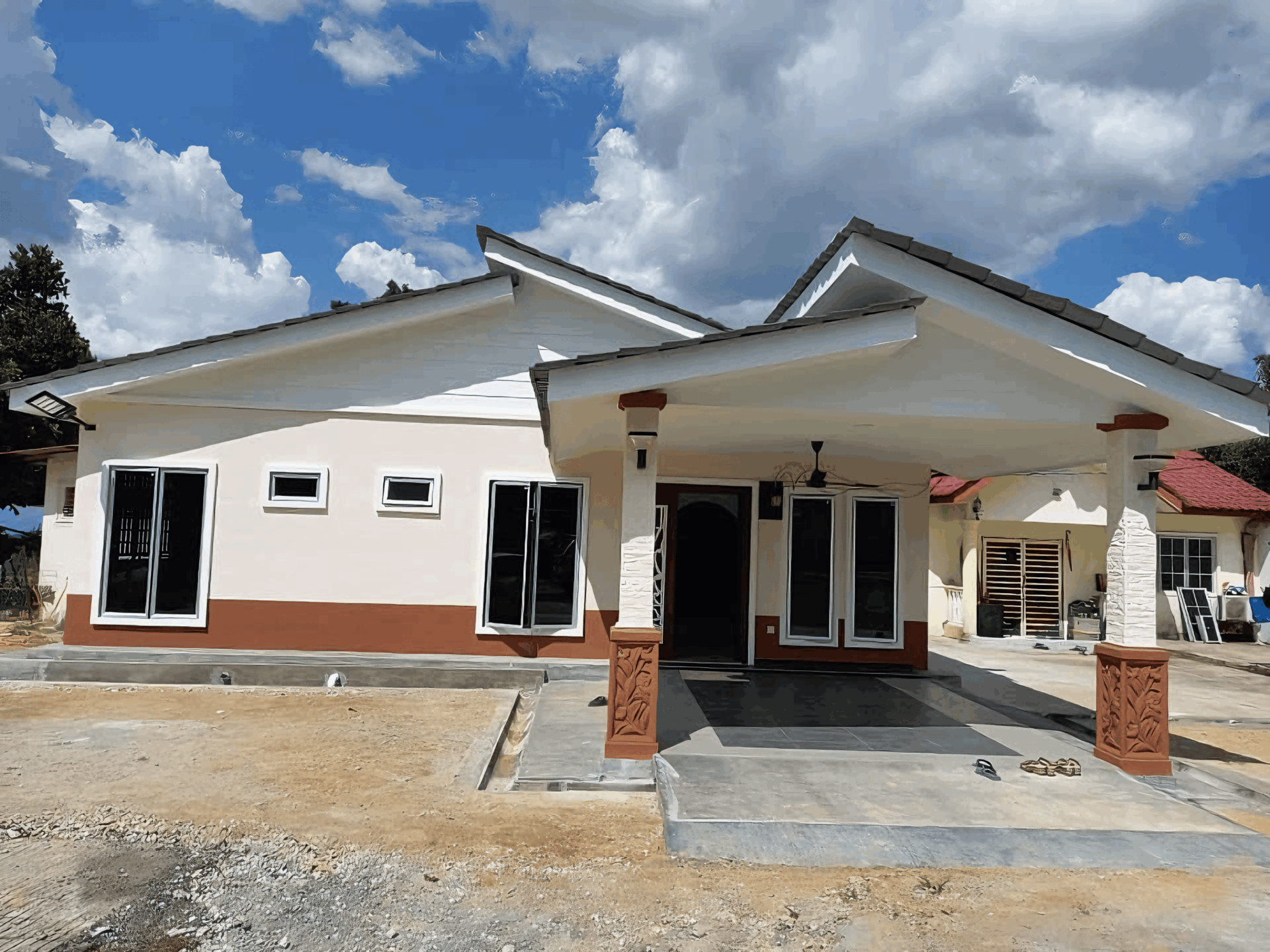

Success Stories: How RumahHQ is Transforming Lives

Future Trends in Home Financing for the Malaysian Market

The Malaysian housing market is evolving rapidly, and it’s crucial for homebuyers to stay informed about the latest trends in financing. Innovations in technology are reshaping how people approach home ownership. Traditional loan processes are being streamlined, making them more accessible than ever. With the advent of flexible financing options from companies like RumahHQ, homebuyers can now unlock new pathways to affordable homeownership that were previously difficult to navigate.

One of the key trends in home financing is the shift towards digital platforms that provide a plethora of financing solutions at the click of a button. This trend is characterized by:

- Instant Approval: Quick online applications that offer same-day results.

- Customizable Plans: Tailored financing that fits individual financial situations.

- Transparent Fees: Clear breakdowns of costs ensuring no hidden surprises.

Additionally, flexible options like rent-to-own schemes and shared ownership are becoming increasingly popular among Malaysians looking to step onto the property ladder. RumahHQ, for instance, provides a unique advantage through various partnership models that allow for lower initial investments while still securing future equity in properties. Here’s a quick look at how these options compare:

| Financing Option | Initial Investment | Ownership Timeline |

|---|---|---|

| Standard Mortgage | High | Long-term |

| Rent-to-Own | Moderate | Medium |

| Shared Ownership | Low | Flexible |

Insights and Conclusions

As we wrap up our exploration of RumahHQ’s financing flexibility, it’s clear that the dream of homeownership is becoming more accessible for many Malaysians. With innovative financing options tailored to fit diverse life situations, RumahHQ is paving the way for a smoother path to owning that perfect home. Whether you’re a first-time buyer or looking to upgrade, the flexibility offered can make a real difference in your journey.

So, if you’re ready to take that leap and make your housing dreams come true, RumahHQ might just be the stepping stone you’ve been searching for. After all, in a place where home is more than just a roof over your head, having the right support can truly help you settle in sooner rather than later. Happy house hunting!